Research

31/10/25

Behind the Headlines: China’s Soybean Reality After the Trump–Xi Meeting

The much-anticipated Trump–Xi meeting on Thursday was as much political theatre as trade diplomacy, “a 12 out of 10,” in Trump’s own words, but its supposed outcome has left markets guessing more than celebrating. U.S. officials claimed that China would buy a “tremendous” 12 million tonnes (Mt) of U.S. soybeans before January, followed by 25 Mt annually over the next three years. Beijing has not confirmed any such commitments, stating only that it will “resume soybean purchasing.” So far, that has translated into three COFCO cargoes, reportedly government-directed purchases for state reserves rather than commercial demand.

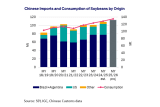

In reality, China has little near-term need for large U.S. soybean imports. Domestic inventories, around 43 Mt, are sufficient to cover crush demand through November, leaving perhaps a modest 5 Mt gap through Feb/Mar 2025 (when Brazilian exports will pick up again). Argentina and Brazil have together supplied nearly all of China’s soybean requirements in MY 24/25 (~78 Mt of the 108 Mt imported). With another bumper Brazilian crop projected for early 2026, potentially exceeding 155 Mt, China’s reliance on South American beans looks set to persist.

Commercially, U.S. soybeans remain at a disadvantage. The 23% Chinese tariff remains in place as far as we know, and there have been no announcements of any tariff suspensions or revisions. Brazilian beans carry higher protein content, and with a narrower US–Brazil FOB price gap of $15/t (down from $40/t earlier in October), factoring in these duties renders U.S. cargoes uncompetitive. Moreover, negative crush margins in China and the expansion of U.S. domestic crushing capacity (+9.2 Mt between 2023 and 2025) further constrain the potential for export recovery. Until there is clarity on any tariff suspension or trade policy adjustment, there is little commercial incentive for Chinese crushers to turn to U.S. supply.

For dry bulk shipping, the implications remain conditional. Bessent’s announcement makes no mention of when the soybeans will be shipped, only stating China will buy 12 Mt before January. It has been questioned whether shipping 12 Mt before the end of the year would even be possible, requiring a pace of 1.33 Mt per week over the next nine weeks. Historical shipping rates suggest this pace would not be completely unrealistic, but certainly towards the upper end of historical performance (the five-year average is 1.28 Mt, with a peak of just over 2.0 Mt in November 2020).

We are not expecting such a strong uptick, but it’s worth highlighting that to sustain such a pace would likely tighten Panamax availability in the North Atlantic, where the fleet currently stands at 437 vessels, down from 476 a year ago. Most U.S. soybean exports (roughly 80%) typically move through the Gulf, although persistently low Mississippi water levels continue to drive up barge rates and could limit throughput. In that optimistic scenario, short-term Panamax demand could strengthen, supporting a brief spike in Atlantic basin rates and volatility.

However, any outcome still depends on formal confirmation from Beijing, the signing of an official agreement, and, crucially, adjustments to China’s existing tariffs. Without those, the current headlines risk remaining just that: headlines, not a turning point for trade or freight.

By William Tooth, Head of Futures Research and Vriddhi Khattar, Dry Bulk Analyst, Research, SSY

Articles

You may also be

interested in

View allGet in touch

Contact us today to find out how our expert team can support your business